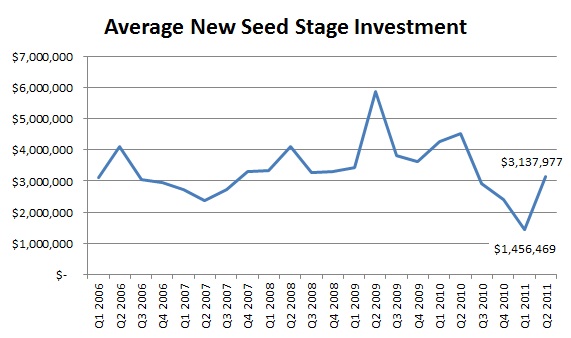

I recently shared that seed investment relative to total venture investment neared an all-time high in the second quarter of 20011. One-third of all new venture deals were made at the seed stage according to data from the National Venture Capital Association and PwC. I thought it might also be useful to share what was going on with the average investment size for new seed deals. Is more of a focus on seed stage deals driving up valuations? Well, yes and no. The average seed investment more than doubled over the first quarter of the year – up from $1.5 million to $3.1 million. So yes, clearly there’s a significant increase from the quarter prior (but I have some issues with that data which I’ll discuss later). On the other hand, the average seed stage investment has averaged $3.3 million since 2006. So we’re actually still below the average in recent history.

Data Source: PricewaterhouseCoopers/National Venture Capital Association MoneyTree™ Report, Data: Thomson Reuters

I think there are a few factors at play that have prevented seed valuations on the whole from rising too much:

- For all the attention some of high profile deals get, they seem to be the exception, not the rule. Huge early stage rounds like the one for Color garner a lot of attention, but I think on the whole, investors have all the talk about us being in a bubble in the back of their heads and are being prudent with deals.

- We also need to remember that most seed deals are in the IT sector, and specifically for internet companies. This means the amount of funding they need in a seed round, on average, is getting smaller because it’s so much cheaper to build a company out to at least to proof of concept. What this does leave room for though is the potential that the amount of investment going into seed deals is getting high relative to the amount they actually need. It’s hard to extract this from just basic investment data.

- There are also alternatives to funding – instead of higher profile companies and entrepreneurs seeking seed funding outright, many are increasingly going to incubators. These programs, such as YCombinator, TechStars and a whole slew of others, are growing in number and size.

- Finally we can question the data source – the NVCA and PwC gets their data from ThomsonReuters which captures data through surveys and only includes institutional investment. So, individual angel investment, for example, is generally excluded.

Back to that issue with the Q1 data - as with the data on the number of new investments, there’s a strange anomaly in Q1 of 2011 with the average deal size as well. It’s as if investors took a dramatic pause in the first quarter – did fewer seed deals, and invested less in each deal. Again, the reason is not quite clear to me because the general impression I got from observing the market was that seed and early stage investment was hot, driven not only by a rise in super angel/micro VC funds, but also more seed investment activity on the part of traditional venture firms. One reason why the data might not match up with anecdotal evidence is that maybe investors were really taking a wait and see approach on how the venture-backed companies that held IPOs in the first quarter did before actually closing on new deals. Clearly a record-setting second quarter in terms of venture-backed IPOs in the IT sector helped boost confidence and probably led to the spike in the relative number of seed stage deals and dollar amounts in Q2. I’m still open to hearing if anyone has any alternate theories.

UPDATE: On his blog Reaction Wheel, Jerry Neumann shared that he has a nagging suspicion about early-stage venture capitalists: "About six months ago it seemed like they were slowing down their pace of investing while the corporates and newer super-angels were doing a lot more deals." If this is true, it surley can help explain the anomoly in Q1 the data. Since only institutional venture firms are included, the suspicion that they slowed up on seed stage deals can actually be confirmed. On the whole though, seed stage investment seemed like it was going strong because in reality, it was - just led by super angels whose deals do not make it into this data. As for if this is a warning sign, I think its too early to tell - but it is intersting that in the next quarter, relative seed stage investment by VCs hit levels last seen right before the bursting of the tech bubble.