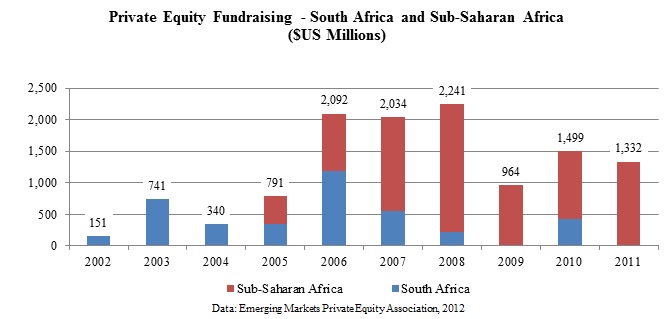

Two major factors seem to have manifested themselves in the major trends in capital-raising for South African private equity firms. One is the continued worldwide economic slowdown, which has not spared the South African private equity industry. Despite a lagged effect on the industry, an impact was clearly felt – particularly in 2009 when no exclusively South African-focused firm raised capital, according to the Emerging Markets Private Equity Association (EMPEA). The second major trend (which also plays into the 2009 results) is the gradual shift away from South Africa being the sole focus of most South Africa-based private equity firms.

As the chart above indicates, South Africa was the dominant destination for capital raised by all private equity firms in Sub-Saharan Africa from 2002 to 2004 (EMPEA, 2012). However, as time has progressed, many firms have begun looking at cross-border opportunities – so much so that most traditional South Africa-focused firms have recently pushed for allowances in their fund documents permitting them to invest up to a specified portion of their funds in other African countries, typically in the range of 20%-30%. This trend is exemplified by the fact that fewer and fewer funds with a sole South African focus have been closing in recent years. Further advancing this trend is the fact that the South African government has enacted tax and exchange control regulations meant to lure private equity firms who want to domicile in South Africa’s less risky environment while venturing out to invest across the sub-continent. As a result, South Africa has become a major hub for many pan-African firms.

Over the past few years, traditional South African firms, instead of jumping into new regions, have started to back South Africa-based companies with a regional footprint or potential for cross-border expansion – to reap the benefits of lower risk while also building experience and expertise in other, faster-growing countries. Many of the aforementioned firms with new allowances to invest specified portions of their most recent funds outside of South Africa have taken this route.

In terms of the sources of capital, Government agencies and Development finance institutions (DFIs) account for the largest portion of funds raised by South African private equity firms, nearly 40% (according to the South African Venture Capital and Private Equity Association, SAVCA). It is believed that these types of organizations play a larger role (and account for a larger proportion of capital raised) in South Africa, and even more so the reset of the continent, than in any other emerging market. Their developmental and social goals are aimed to be fulfilled not only directly though their investments in private equity funds, but also indirectly by acting as a catalyst for the private equity industry and the firms in which they invest. For this reason, these organizations will often be looked at to take the lead on investments in funds sponsored by new firms – to “give comfort to others” as one DFI has put it. Their goals, however, also necessitate more detailed reporting on the part of fund managers.

Other major types in investors, or limited partners, in South African private equity firms include insurance companies, pension funds and family offices – each representing between 16% and 17% of capital raised (SAVCA). Insurance companies, predominantly domestic, have long been a source of capital for South African private equity firms. Pension fund capital has been slow to participate in South African private equity, particularly international pension funds. Recent legislation has increased the cap on the allocation to private equity for domestic pension funds and is expected to lead to a rise in their role in the private equity industry in South Africa. Funds of funds have recently emerged on the scene in South Africa in a big way - in fact the capital invested by funds of funds doubled from 2009 to 2010. This, in many ways, can be taken as a sign of the South African private equity industry’s maturation since funds of funds, particularly those that are regionally focused, generally only emerge when a region’s private equity industry can support an attractive diversified portfolio of private equity funds.

Finally, it is important to note that the majority of capital, around 58%, is sourced from abroad (SAVCA). This means that private equity plays an important role in garnering foreign direct investment (FDI). It also means that South African private equity firms have to spend time and money traveling around the world to attain commitments from investors because of the limited availability of local capital. This can present a number of challenges, particularly for younger firms who not only have to battle the risk perception of being an African private equity firm, but also the risks investors associate with first-time fund managers. The bulk of international capital is sourced from Europe which accounts for almost a quarter of call capital raised (including the UK). European countries’ often closer ties to Africa explain their heightened role. Meanwhile, Asian, and North and South American countries have been slow to warm to South African private equity, in part because of better perceived risk-adjusted returns available closer to home.

As the market continues to mature and Africa as a continent becomes more and more of an attractive destination for private equity and venture capital investment, fundraising trends will undoubtedly change. Nonetheless, current characteristics will continue to shape near-term progress and while leaving their mark on the industry for years to come.