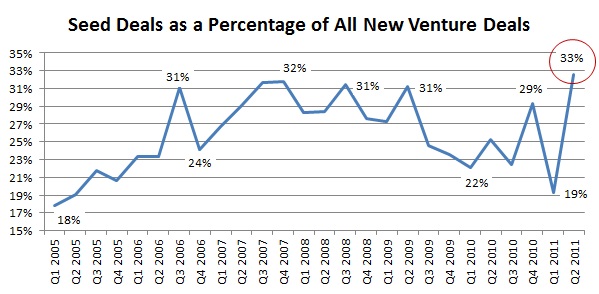

Relative Seed Stage VC Investment Nears All-Time High

Saturday, July 30, 2011 at 11:44PM

Saturday, July 30, 2011 at 11:44PM Last week, US venture capital investment data through the second quarter of the year was made available by the National Venture Capital Association and PwC. What stood out to me most was that seed stage deals rose to account for one-third (33%) of all new venture capital investments in the second quarter. This was the highest such level since the first quarter of 1999 (yes, over 12 years ago!). Only three other quarters (all in 1998) come close to reaching the one-third mark (the data goes back to 1995). Essentially, we are just about at an all-time high in seed investing relative to all other venture investment. In absolute terms, $317 million was invested across 101 new seed deals. Both these figures have been eclipsed in recent history, however, looking at the relative level of investment gives us better insight as to what is happening in the venture industry at any time, regardless of its size. Also, as I have mentioned before, because most venture industry data is not consistent in terms of quality, it’s better to look at trends rather than focus on specific numbers.

Data Source: PricewaterhouseCoopers/National Venture Capital Association MoneyTree™ Report, Data: Thomson Reuters

The reasons for a rise in seed stage funding are seemingly pretty clear - the data helps perhaps confirm the growth and institutionalization of Super Angel/Micro VC funds as well as the recognition of the importance and benefits of seed investment by larger venture firms with more diversified strategies. The interesting thing about the last time seed investment hit these levels was that it was right before the bursting of the internet bubble. Perhaps a high relative level of seed investment is a leading indicator for a tech/vc bubble. I think this is a controversial topic and I won’t stray into my thoughts too much but I think it’s very hard to tell if we are in a tech bubble. You probably can never know for sure if there has been a bubble until it pops. In general, I do believe higher level of seed investment is healthy for the venture ecosystem, as long as valuations are reasonable.

One other thing that stands out when looking at the data is the temporary, but sharp, drop in the relative level of seed investment in the first quarter of 2011. I can’t help but think this was just a random anomaly, because no other stage of venture investment experienced the same volatility. I can’t think of any convincing reason why the drop would have been so large for just the first quarter. Feel free to comment if you have any suggestions. It should be interesting to see what the data shows us for the coming quarters. I’ll be sure to provide an update when new data is released.

UPDATE: On his blog Reaction Wheel, Jerry Neumann shared that he has a nagging suspicion about early-stage venture capitalists: "About six months ago it seemed like they were slowing down their pace of investing while the corporates and newer super-angels were doing a lot more deals." If this is true, it surley can help explain the anomoly in Q1 the data. Since only institutional venture firms are included, the suspicion that they slowed up on seed stage deals can actually be confirmed. On the whole though, seed stage investment seemed like it was going strong because in reality, it was - just led by super angels whose deals do not make it into this data. As for if this is a warning sign, I think its too early to tell - but it is intersting that in the next quarter, relative seed stage investment by VCs hit levels last seen right before the bursting of the tech bubble.

AV | |

AV | |