Mixed Signals

Tuesday, September 20, 2011 at 11:40PM

Tuesday, September 20, 2011 at 11:40PM

Usually you can gauge the health and general attractiveness of venture capital by looking at what’s going on with fundraising, investment levels, valuations and exits. What is deemed healthy or attractive in most cases depends on whether you’re an entrepreneur, venture capitalist or limited partner, but it’s typically pretty clear if times are good or bad for you. Recently though, it seems as if the indicators are sending very mixed signals. Here’s a quick overview of what’s happening:

Fundraising: Fundraising has been brutally difficult for venture firms ever since 2008. It seemed as though the situation was improving in the first quarter when we got off to the best annual start for fundraising since 2001. However, the quarter’s improvement was really driven by three firms raising billion dollar funds – Bessemer Venture Partners, Sequoia Capital and JP Morgan (their Digital Growth Fund – not really a venture fund in the traditional sense). Non big-name firms have had real difficulties raising funds, as evidenced in the second quarter of the year which featured the lowest number of funds garnering commitments since the first half of 1995. It can be argued that this is actually a good thing (for limited partners at least) since historically, lower fundraising has been correlated with higher returns.

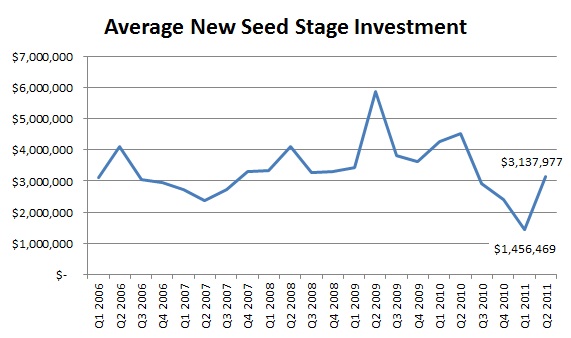

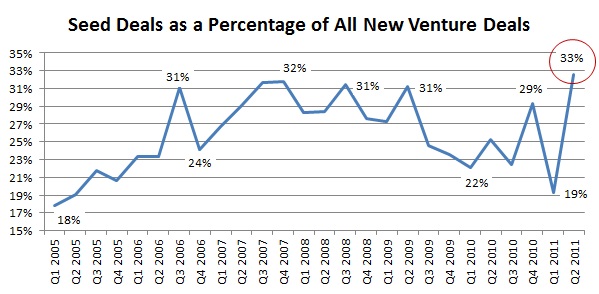

Investment Levels: Venture investment activity has been volatile since 2008 but generally has displayed an upward trajectory, in both, the number of deals and total dollars invested (in fact, in the second quarter investment in Internet-specific companies rose to the highest quarterly level since 2001). A couple things are troubling. For one, investment continues to outpace fundraising and at some point will have to come down as many firms currently deploying capital will be unable to raise new funds. Another issue is that the rise in overall number of deals is being driven by seed and early stage investments while the rise in overall dollars is being driven by later stage deals. This means companies in between are competing for a smaller pool of capital. It can be argued that this is good thing because only those companies with proven models are making it to later stages, but I think the dynamic is also reflective of the overly rapid institutionalization of seed investing and a huge interest that formed around specific later stage companies.

Valuations: According to the Fenwick & West Venture Capital Barometer, Silicon Valley companies funded in the second quarter of 2011 showed an average price increase of 71% - up significantly from the 52% reported for the first quarter and the highest such result since 2007. With the third quarter seemingly very unsettled it should be interesting to see where things go. Anecdotally, seed and early stage deals still seem to be commanding high valuations. This is in part due to a huge influx of capital competing for deals as so many more venture firms and individuals are jumping into seed investing.

Exits: The exit market often reflects what’s happening in the public markets and broader macro environment and so right now there seems to be a lot of uncertainty. Officially, according to NVCA statistics, we are on pace to have the best year for VC-backed exits (both via M&A and IPO) since at least 2007. However, a lot of the activity is being driven by Chinese companies and it seems as though exit activity seems to have slowed in the third quarter (we’ll know officially soon). Large companies still have lots of cash but seem to be getting more selective again. The IPO window looks to be shrinking and many companies that have recently IPO-ed have not performed so well post-IPO. Good companies are definitely “exitable” but the bar seems higher than it was just a few months ago.

So what do we have? Fundraising data indicates it might be a great time to be an investor in venture capital. Investment levels are telling us that venture capitalists are excited about young companies but valuation data tells us that deals are as pricey as ever. The exit market had been great through the first half of the year but things are starting to look shaky – in line with the public markets and the macroeconomic environment. On one hand things are great, on the other, maybe not so much. The only way I can make sense of it all is to remember that the venture industry is significantly more cyclical than most people realize. We clearly were headed up out of a trough but now I think the industry is in a holding pattern trying to figure out whether or not it should continue moving upward or if it’s already peaked. It’s important to note that venture capital returns of late have been great.

What I think will happen is that the lower fundraising levels (which are, or should be, the “new normal”) will eventually lead to a slowdown in investment activity and, in turn, a decrease in valuations. All of this can be considered good or healthy in many respects. The exit market is hard to predict and hedges a lot on the macro environment but it’s safe to say that good companies can still be attractive acquisition or IPO candidates. On the whole though, I doubt even an amazing exit market will lead to a boost in fundraising so investment activity should really remain steady or decline. Perhaps the industry data has just been hard to make sense of because the effects of the “new normal” levels of fundraising haven’t yet trickled down to investment valuations. It should be very interesting to see how the rest of the year shakes out and where all the variables stand at year – only then do I think we’ll know if we’re moving out of this holding pattern and in which direction.

AV | |

AV | |